Metro Pacific Investments Corporation

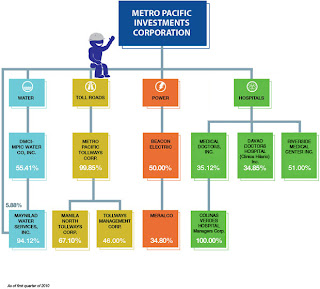

Metro Pacific Investments Corporation is raising the groundwork of basic services into a whole new level of systems and organizational initiatives to pave the way for a strategic response to the changing times. We are moving up on our commitment to meet the growing demand for vital services reaching far and wide, while providing continuous supply of clean and potable water, efficient distribution of electrical power, state-of-the-art tollway systems and world-class medical care.

AGI's business units—Megaworld Corporation (Megaworld) for real estate (RE); Emperador Distillers, Inc. (EDI) for food and beverage (F&B); Golden Arches Development Corporation (GADC) for quick-service restaurants (QSR); and Travellers International Hotel Group, Inc. (Travellers International) for tourism and gaming—are considered the building blocks of growth not only for the company itself but for the country as well.

Megaworld Corporation

Through the years, Megaworld has been developing integrated mega-communities that offer basically everything that tenants want and need. This the Company does in pursuit of its prime objective of providing the "perfect" community that offers comfort, convenience and everything else.Emperador Brandy

Emperador Brandy, EDI's flagship product, continues to do very well in the market and is still considered the drink that features the distinct taste of success.McDonald's

McDonald's leads the industry in terms of overall food quality, overall service, and value for money. GADC's thrust is to improve the quality of food that it serves and the overall experience in all McDonald's branches.Travellers International Hotel Group, Inc.

Travellers' first project was Resorts World Manila, the country's very first integrated tourism estate that opened to the public in August 2009. Travellers International will spend over US$500 million to develop Resorts World Manila, which includes the all-suite Maxims Hotel, the five-star Marriott Hotel, the Luxury Hamilton Hotel, and the budget Remington Hotel. The resort also features a grand mall, a world-class theater that seats 1,500 people, restaurants, high-end luxury shops, an exclusive lifestyle club, spas, and gaming areas.