[hur-mi-tij or, for 3, er-mi-tahzh]

Wednesday, December 29, 2010

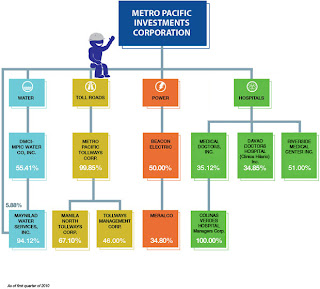

2011 Areas Of Possible Investment

Sunday, December 5, 2010

Warren Buffett's Worst Mistakes

Warren Buffett is widely regarded as one of the most successful investors of all time. Yet, as Buffett is willing to admit, even the best investors make mistakes. Buffett's legendary annual letters to his Berkshire Hathaway (BRK-A) shareholders tell the tales of his biggest investing mistakes.

Lesson Learned

It's easy to get swept up in the excitement of big rallies and buy in at a prices that you should not have -- in retrospect. Investors who control their emotions can perform a more objective analysis. A more detached investor might have recognized that the price of crude oil has always exhibited tremendous volatility and that oil companies have long been subject to boom and bust cycles.

Buffett says: "When investing, pessimism is your friend, euphoria the enemy."

U.S. Air

Mistake: Confusing revenue growth with a successful business

Buffett bought preferred stock in U.S. Air (LCC) in 1989 -- no doubt attracted by the high revenue growth it had achieved up until that point. The investment quickly turned sour on Buffett, as U.S. Air did not achieve enough revenues to pay the dividends due on his stock. With luck on his side, Buffett was later able to unload his shares at a profit. Despite this good fortune, Buffett realizes that this investment return was guided by lady luck and the burst of optimism for the industry.

Lesson Learned

As Buffett points out in his 2007 letter to Berkshire shareholders, sometimes businesses look good in terms of revenue growth but require large capital investments all along the way to enable this growth. This is the case with airlines, which generally require additional aircraft to significantly expand revenues. The trouble with these capital-intensive business models is that by the time they achieve a large base of earnings, they are heavily laden with debt. This can leave little left for shareholders and makes the company highly vulnerable to bankruptcy if business declines.

Buffett says: "Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it."

Dexter Shoes

Mistake: Investing in a company without a sustainable competitive advantage

In 1993, Buffett bought a shoe company called Dexter Shoes. Buffett's investment in Dexter Shoes turned into a disaster because he saw a durable competitive advantage in Dexter that quickly disappeared. According to Buffett, "What I had assessed as durable competitive advantage vanished within a few years." Buffett claims that this investment was the worst he has ever made, resulting in a loss to shareholders of $3.5 billion.

Lesson Learned

Companies can only earn high profits when they have some sort of a sustainable competitive advantage over other firms in their business area. Wal-Mart (WMT) has incredibly low prices. Honda (HMC) has high-quality vehicles. As long as these companies can deliver on these things better than anyone else, they can maintain high profit margins. If not, the high profits attract many competitors that will slowly eat away at the business and take all the profits for themselves.

Buffett says: "A truly great business must have an enduring "moat" that protects excellent returns on invested capital."

The Bottom Line

While making mistakes with money is always painful, paying a few "school fees" now and then doesn't have to be a total loss. If you analyze your mistakes and learn from them, you might very well make the money back next time. All investors, even Warren Buffett, must acknowledge that mistakes will be made along the way.

Friday, October 22, 2010

Monday, October 11, 2010

10 investing basics from Buffett

Lesson No. 1: Be frugal

If the economic downturn is forcing you to live simply, look on the bright side: It's making you more like Buffett.Buffett lives in the same modest house in Omaha, Neb., that he bought more than five decades ago. He drives his own car.

How does this make him a better investor? First, it gives him more to invest.

Second, a frugal investor will demand this quality from managers. Buffett is leery of corporate waste. Excessive executive pay or silly perks are red flags. Buffett once quipped that companies stack pay committees with "sedated Chihuahuas."

Third, frugal people don't need fast returns to support extravagant lifestyles. This leaves them free to think more clearly about when to buy and sell stocks, making them much better investors, believes Stephen Shueh, a Buffett expert and managing partner of Roundview Capital in Princeton, N.J.

Lesson No. 2: Wait for the 'fat pitch'

Resist the itch to constantly buy or sell stocks."Lethargy bordering on sloth remains the cornerstone of our investment style," quipped Buffett in his 1990 annual report to Berkshire Hathaway (BRK.A, news, msgs) shareholders. Have the patience to wait a long time until some market turbulence brings the "fat pitch," as Buffett calls it, or stocks of great companies trading at really cheap valuations.

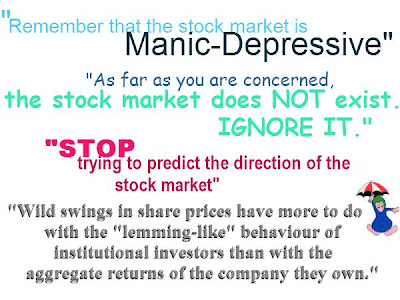

Lesson No. 3: Be a contrarian

A great way to make money is to go against the crowd. "We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful," Buffett explained in a 1986 letter to shareholders.So be skeptical of the conventional wisdom. Not because the crowd is always wrong but because the crowd's wisdom is probably already reflected in market prices, says Todd Lowenstein, a portfolio co-manager of the HighMark Value Momentum Fund (HMVMX).

When the investing public is extremely negative, it's usually a good time to buy stocks. When investors are confident, be careful.

Lesson No. 4: Stick with what you know

One of Buffett's basic rules is: If you don't understand a company's product or how it makes money, avoid it. He calls this "staying within your circle of confidence."

This isn't always easy. During the late 1990s boom, Buffett famously avoided tech companies, confessing that he could not understand what they did. He looked dumb until the bubble burst. "Ultimately, when it came full circle, he was proven right," Lowenstein says.

Lesson No. 5: Don't depend on others to say you're right

If you are in need of constant affirmation about your investment decisions, particularly from the stock market, you won't be able to invest like Buffett, points out Legg Mason (LM, news, msgs) money manager Robert Hagstrom in his book "The Warren Buffett Way."That's because Buffett makes outsized returns by purchasing disliked value stocks that are so beaten down they're often virtually ignored by the talking heads. They won't be on TV every week telling you that you made the right choice.

Lesson No. 6: Buy companies cheap

This is the essence of being a value investor. The first step involves calculating what Buffett calls an "intrinsic value" for a business -- either by examining what similar companies sell for or calculating the present value of all the cash that will be generated by a company in the future. For more details on how to do this, you'll have to consult books such as "The Warren Buffett Way" or "The Market Gurus" by Validea's John Reese.Next, build in a "margin of safety" by purchasing a stock well below its intrinsic value.

Buffett doesn't pay much attention to earnings per share, a common measure of value. Instead, he likes to see companies with good return on equity, solid operating margins and reasonable or no debt. He also likes to see that companies generate a lot of cash and that they invest it well or return it to shareholders in the form of dividends or buybacks.

The key throughout this analysis is to look back over five years or more. Buffett wants to see a consistent operating history; he's not into startup companies. He also prefers to gauge how well a company does in different kinds of markets, not just the good times or the latest quarter.

Lesson No. 7: Look for companies with economic moats

A key characteristic supporting consistent operating history is a sustainable competitive advantage. In other words, a company should have a barrier to entry -- or a kind of moat -- that keeps potential competitors at bay.This could be a patent protection on drugs, high costs to get into a business or simple brand power, fund manager Lowenstein says. "Franchise" businesses like these can do well because they have the power to raise prices. In contrast, companies in "commodity" businesses have to take whatever price is set by a competitive market -- which can crush profits during hard times.

BNSF Railway is a great example of a "franchise" business. It's pretty hard for anyone to lay enough track in North America to start a competing railroad. Coca-Cola (KO, news, msgs), another long-term Buffett holding, has barriers to entry in the form of a strong global brand and distribution system that is hard to replicate.

Lesson No. 8: Buy big, concentrated positions

Most professional money managers protect against risk by diversifying. Buffett goes against the crowd here, too. When he finds a company he likes, he piles into it big time.This is crucial to his success. Money manager Hagstrom calculates that if you eliminate a dozen of Buffett's best investment choices over his career, he's only an average performer. Buffett thinks his risk protection comes from understanding a business better than the market does and then being patient enough to buy it at the right price.

Lesson No. 9: Hold for life

Buffett quips that his favorite holding period is "forever." Embedded in this concept are two key Buffett tenets I've already alluded to. First, it's worth investing only in companies that are good enough to outperform for decades. Next, you have to think on your own and avoid the madness of the crowd."Buffett believes that unless you can watch your stock holdings decline by 50% without becoming panic-stricken, you should not be in the stock market," Hagstrom says.

This doesn't mean buy and forget. Buffett tracks his investments closely and gets out when he thinks that they are fully valued or that trouble is on the way, points out Pat Dorsey, the director of stock analysis at Morningstar (MORN, news, msgs). A few years back, Buffett sold big positions in Fannie Mae (FNM, news, msgs) and Freddie Mac (FRE, news, msgs), the home mortgage companies that blew up last year.

Buffett is not infallible, however. He still owns big positions in Gannett (GCI, news, msgs) and Washington Post (WPO, news, msgs) even though he forecast at his 2004 annual meeting that the newspaper business would see nothing but trouble for decades.

The price of his company's stock -- always a major part of his wealth -- dropped 31% in 2008 and continued to follow the market down early this year. Since, it and the market have rallied strongly.

Lesson No. 10: Believe in America

Unlike most investors, Buffett doesn't tweak his portfolio depending on which party is coming into office or where we are in the economic cycle. This may make him seen naive. But it also has him putting money to work now, when many others have lost faith in the U.S. economic system. It's a move that will likely make him a winner down the road yet again.After all, the current fears about the long-term prosperity of U.S. companies make no sense, he wrote in an October op-ed column in The New York Times. That's why he was buying stocks before the current rally began.

"These businesses will indeed suffer earnings hiccups, as they always have," he wrote. "But most major companies will be setting new profit records five, 10 and 20 years from now."

Sunday, October 3, 2010

The Hermitage Investment Guidelines

4) "The best stock to buy may be the one you already own." Peter Lynch

6) "I was attracted to fast-food restaurants because they were so easy to understand. A restaurant chain that succeeded in one region had an excellent chance of duplicating its success in another." Peter Lynch

6) "I was attracted to fast-food restaurants because they were so easy to understand. A restaurant chain that succeeded in one region had an excellent chance of duplicating its success in another." Peter Lynch 7) "I don't like to sell. We buy everything with the idea that we will hold them forever... That's the kind of shareholder I want with me in Berkshire. I've never had a target price or a target holding period on a stock." Warren Buffett

7) "I don't like to sell. We buy everything with the idea that we will hold them forever... That's the kind of shareholder I want with me in Berkshire. I've never had a target price or a target holding period on a stock." Warren Buffett 9) "I try to stress the idea that a portfolio should have at least ten companies, with one or two providing a fairly good dividend... they have to explain what the company does. If they can't tell the class the service it provides or the products it makes, then they aren't allowed to buy." Peter Lynch

9) "I try to stress the idea that a portfolio should have at least ten companies, with one or two providing a fairly good dividend... they have to explain what the company does. If they can't tell the class the service it provides or the products it makes, then they aren't allowed to buy." Peter Lynch10) "Never invest in any idea you can't illustrate with a crayon." Peter Lynch

Friday, October 1, 2010

Peter Lynch

Beating the Street

--------------------------------

"The best stock to buy may be the one you already own."

"Buying stock in utility companies is good because it gives you a higher dividend,but you'll make money in growth stocks.

Never invest in any idea you can't illustrate with a crayon.

"I try to stress the idea that a portfolio should have at least ten companies, with one or two providing a fairly good dividend... they have to explain what the company does. If they can't tell the class the service it provides or the products it makes, then they aren't allowed to buy."

"Over the last seventy years the market has declined forty times, so an investor has to be willing to be in the market for the long term."

"When the first shopping malls were built, Sears was in ninety-five percent of them... Now when I invest in a stock, I'll know to invest in a company that has room to grow."

"A good company usually increases its dividend every year."

"You can lose money in a very short time but it takes a long time to make money"

"The stock market really isn't a gamble, as long as you pick good companies that you think will do well, and not just because of the stock price."

"You can make a lot of money from the stock market, but then again you can also lose money, as we proved."

"You have to research the company before you put your money into it."

"When you invest in the stock market you should always diversify."

"You should invest in several stocks because out of every five you pick, one will be very great, one will be really bad, and three will be OK."

"Never fall in love with a stock; always have an open mind."

"You shouldn't just pick a stock - you should do your homework."

"Just because a stock goes down doesn't mean it can't go lower."

"Over the long term, it's better to buy stocks in small companies."

"You should not buy a stock because it's cheap but because you know a lot about it."

"Hold no more stocks than you can remained informed on."

"Invest regularly."

"You want to see, first, that sales and earnings per share are moving forward at an acceptable rate and, second, that you can buy the stock at a reasonable price."

"Buy or do not buy the stock on the basis of whether or not growth meets your objectives and whether the price is reasonable."

"The dividend is such an important factor in the success of many stocks that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 or 20 years in a row."

"The extravagance of any corporate office is directly proportional to management's reluctance to reward the shareholders."

"I was attracted to fast-food restaurants because they were so easy to understand. A restaurant chain that succeeded in one region had an excellent chance of duplicating its success in another."

"I always ended these discussions by asking: which of your competitors do you respect the most?"

"I always look for banks that have a strong local deposit base, and are efficient and careful commercial lenders."

"90 seconds is plenty of time to tell the story of a stock. If you're prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so that fifth grader won't get bored."

"Bargains are the holy grail of the true stockpicker. The fact the 10 to 30 percent of our net worth is lost in a market sell-off is of little consequence. We see the latest correction not as a disaster but as an opportunity to acquire more shares at low prices. This is how great fortunes are made over time."

"Once you've bought a stock, presumably you've learned something about the industry and the company's place within it, how it behaves in recessions, what factors affect the earnings, etc. Inevitably, some gloomy scenario will cause a general retreat in the stock market, your old favorites will once again become bargains, and you can add to your investment."

"If you like the store, chance are you'll like the stock."

"The very homogeneity of taste in food and fashion that makes for a dull culture also makes fortunes for owners of retail companies and of restaurant companies as well. What sells in one town is almost guaranteed to sell in another."

"As long as the same-store sales are on the increase, the company is not crippled by excessive debt, and it is following its expansion plans as described in its reports, it usually pays to stick with the stock."

"When an industry gets too popular, nobody makes money there anymore... In business, competition is never as healthy as total domination. The greatest companies in lousy industries share certain characteristics. They are low-cost operators, and penny-pinchers in the executive suite. They avoid going into debt. They reject the corporate caste system that creates white-collar Brahmins and blue-collar untouchables. Their workers are well paid and have a stake in the companies' future. They find niches, part of the market that bigger companies have overlooked. They grow fast - faster than many companies in the fashionable fast-growth industries."

“The typical big winner in the Lynch portfolio generally takes three to ten years to play out”

“All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.”

“Visiting stores and testing products is one of the critical elements of the analyst’s job”

“Getting the story on a company is a lot easier if you understand the basic business. That’s why I’d rather invest in panty hose than in communication satellites, or in motel chains than in fiber optics. The simpler it is, the better I like it.”

“You can get tenbaggers in companies that have already proven themselves. When in doubt, tune in later.”

Wednesday, September 22, 2010

Dollar Cost Averaging

Dollar Cost Averaging

- Simple Averaging

- 1000 shares ATT @ $50 per share = $ 50,000 1000 shares ATT @ $20 per share = $ 20,000

Total Cost $ 70,000

Average Cost ($70,000/2000 shares) $ 35 per share

- Dollar Cost Averaging

- 1000 shares ATT @ $50 per share = $ 50,000 2500 shares ATT @ $20 per share = $ 50,000

Total Cost $ 100,000

Average Cost ($100,000/3500 shares) $ 28 per share

- Using Simple Averaging

- 1000 shares Lucent @ $80 per share = $ 80,000 1000 shares Lucent @ $5 per share = $ 5,000

Total Cost $ 85,000

Average Cost ($85,000/2000 shares) $ 42.50 per share

- Using Dollar Cost Averaging

- 1000 shares Lucent @ $80 per share = $ 80,000 16000 shares Lucent @ $5 per share = $ 80,000

Total Cost $ 160,000

Average Cost ($160,000/17,000 shares) $ 9 per share

- You better be sure that this stock is coming back, or you will get your clock cleaned You have to be absolutely comfortable with your knowledge base concerning the stock in question, or you will be scared out at the bottom. This means you will be selling, instead of buying the stock

You have to have the cash to play in this arena. This is why you never ever go on MARGIN. Margin kills

As part of point 3) above, always keep some dollars in reserve.

Saturday, September 11, 2010

The 15 Best Things Warren Buffett Has Ever Said About Investing

Friday, September 10, 2010

Warren Buffet Quotes

Someone's sitting in the shade today because someone planted a tree a long time ago. Warren Buffett

Your premium brand had better be delivering something special, or it's not going to get the business.

You do things when the opportunities come along. I've had periods in my life when I've had a bundle of ideas come along, and I've had long dry spells. If I get an idea next week, I'll do something. If not, I won't do a damn thing.

Wide diversification is only required when investors do not understand what they are doing.

Why not invest your assets in the companies you really like? As Mae West said, "Too much of a good thing can be wonderful".

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.

Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.

Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.

Our favorite holding period is forever.

Price is what you pay. Value is what you get.

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.

Risk comes from not knowing what you're doing.